Rio Tinto strategic partnership announced

1 OCTOBER 2024, LONDON

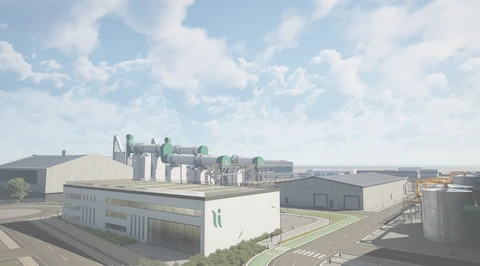

Green Lithium, the UK-based, low-carbon lithium refinery developer, has today announced the signing of a memorandum of understanding to develop a lithium supply chain commercial partnership with Rio Tinto, the global metals processing and mining company.

This agreement marks another step for both parties as they look to play a crucial role across the fast-evolving European battery metals value chain. Ultimately, the parties share the vision of building an end-to-end value chain that provides security of supply to safeguard the UK’s and EU’s automotive and battery manufacturing industries.

Sean Sargent, Chief Executive Officer of Green Lithium, said: “The EV and battery revolutions are fundamental to reducing the carbon emissions that contribute to global climate change. By building our refineries, we will accelerate the adoption of EVs and sustainable energy storage through the increased supply of low-carbon, battery-grade lithium chemicals. Fulfilling this vision requires the right partners, and in Rio Tinto we have found an exceptional potential commercial partner.”

“Rio Tinto and Green Lithium share ambitions related to decarbonisation and today’s announcement is an important step forward in our journey towards unlocking the end-to-end battery metals supply chain in Europe. Alongside Green Lithium, we are looking to supply the global rollout of green battery technology to feed the significant European market demand.”

Sarah Jones MP, UK Government Minister for Industry and Decarbonisation, said: “This is great news for Green Lithium and Rio Tinto and will not only support high-skilled jobs in the North East but boost our critical minerals supply chains as we continue to build a cleaner, greener future for our automotive industry and drive forward our mission to net zero.”

Fundraising contacts

Green Lithium is raising capital from corporate/institutional investors. To register interest, please contact a member of the deal team at its lead adviser Stifel Nicolaus Europe.

- Varun Talwar, European Head of Metals & Mining: varun.talwar@stifel.com

- Alex Boyce, Head of Capital Solutions: alex.boyce@stifel.com

- George Moore-Gwyn, Director in Capital Solutions: george.moore-gwyn@stifel.com